Table of Content

Homeownership provides the certainty of knowing where you’ll live from one year to the next. Getting preapproved is one of the first steps in the homebuying process. Without a preapproval, you won’t be able to make a successful offer on a home. Things can directly impact the specific interest rate you’ll qualify for.

Some analysts believe fixed mortgage rates might dip back into the 5 percent range in 2023. The loan terms shown above do not include amounts for taxes or insurance premiums. Your monthly payment amount will be greater if taxes and insurance premiums are included. The above mortgage loan information is provided to, or obtained by, Bankrate. Some lenders provide their mortgage loan terms to Bankrate for advertising purposes and Bankrate receives compensation from those advertisers (our "Advertisers").

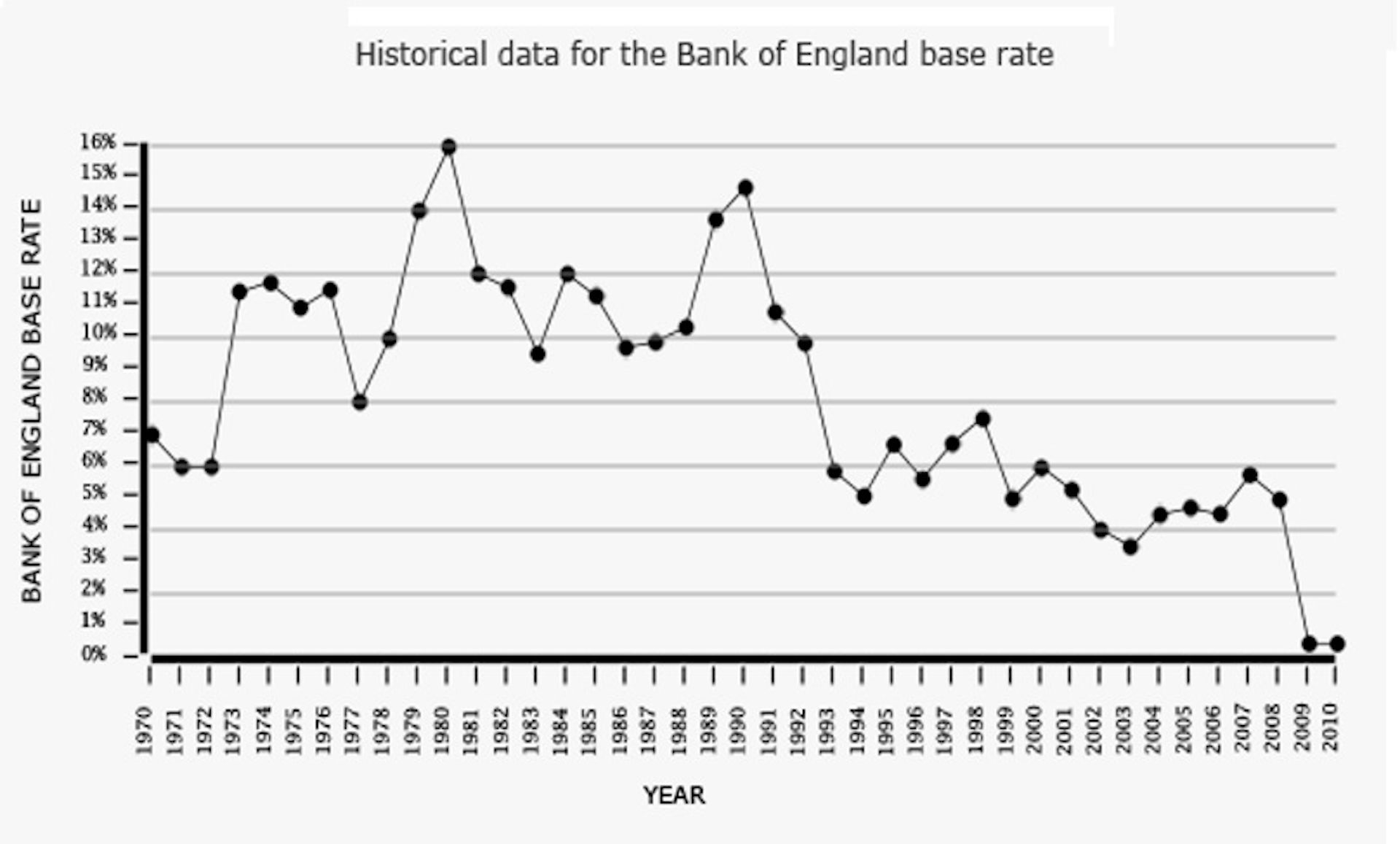

The all-time high for mortgage rates

However, to get the most accurate quote, you can either go through a mortgage broker or apply for a mortgage through various lenders. Some fees may be charged annually or monthly, like private mortgage insurance. That’s why, in a slumping economy, when more investors want to purchase safer investments, like mortgage-backed securities and treasury bonds, rates tend to go down. The Federal Reserve has been purchasing MBS and treasury bonds, and this increased demand has led to the lowest mortgage rates on record. When a lender issues a mortgage, it takes that loan and packages it together with a bunch of other mortgages, creating a mortgage-backed security , which is a type of bond. These bonds are then sold to investors so the bank has money for new loans.

The lender will consider a number of factors in determining a borrower's mortgage rate, such as the borrower's credit history, down payment amount or the home's value. Inflation, job growth and other economic factors outside the borrower's control that can increase risk also play a part in how the lender sets their rates. There is no exact formula, which is why mortgage rates typically vary from lender to lender. For example, by paying upfront 1% of the total interest to be charged over the life of a loan, borrowers can typically unlock mortgage rates that are about 0.25% lower. Short-term loans have higher monthly payments but lower interest rates.

Mortgage calculator

You could save thousands of dollars through the life of the loan. In 2018, many economists predicted that 2019 mortgage rates would top 5.5 percent. The average mortgage rate went from 4.54% in 2018 to 3.94% in 2019. As a borrower, it doesn’t make much sense to try to time your rate in this market.

Federal Reserve Chairman Jerome Powell said in September that a “difficult correction” may be necessary for the housing market, which has been out of balance due to limited supply and high demand. Mortgage rates went from near-record lows to the highest in 13 years in a matter of just a few months, with weekly jumps of 10 basis points or more. According to the Consumer Price Index, inflation was up 7.1% year-over-year in November, an encouraging signal that inflation is cooling.

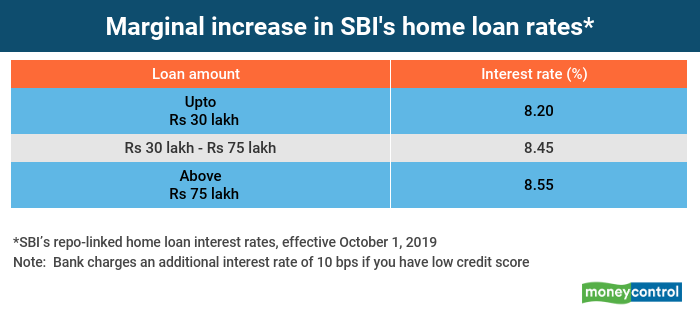

Home Loan by Top Banks

However, in case of floating interest rate you can take advantage of the lower interest rates during the loan tenure. You can calculate your home loan interest rate using the home loan EMI calculator, which mainly calculates the EMI amount but also displays the total interest payable on your home loan. You will need to list the debts you have which helps the lender understand your DTI ratio, which is vital to determining how much of a mortgage loan you can afford. Another important consideration in this market is determining how long you plan to stay in the home.

You will purchase up to one mortgage discount pointin exchange for a lower interest rate. Connect with a mortgage loan officer to learn more about mortgage points. Be sure to ask your lender about the consequences of not closing within the timeframe specified in a rate lock agreement and also about what could happen if rates fall after you lock in a rate.

When to lock your mortgage rate

They’re not directly tied to the Federal Reserve’s fed funds rate, although this benchmark rate can help influence the direction mortgage rates are headed. Other factors that influence mortgage rates include the health of the economy, the inflation rate, and how much demand lenders are seeing for home buying and refinancing. Only adjustable-rate mortgages are directly tied to market indices and therefore to the Fed’s benchmark rate.

If you took out a $300,000 home loan with a 30-year fixed rate of 5.5%, you’d pay around $313,000 in total interest over the life of the loan. The same loan size with a 15-year fixed rate of just 5.0% would cost only $127,000 in interest — saving you around $186,000 in total. In this post we’ve tracked rates for 30-year fixed-rate mortgages. But 15-year fixed-rate mortgages tend to have even lower borrowing rates. A credit score of 620 or higher might qualify you for a conventional loan, and — depending on your down payment and other factors — potentially a lower rate. If possible, give yourself a few months or even a year to improve your credit score before borrowing.

Many Americans have been priced out of the market as home prices have skyrocketed over the past two years. That means there is more demand in the rental market than usual, so that’s where developers have been focusing their energy. If we look at multi-family housing projects with five units or more exclusively, new builds skyrocketed, up 28.6%.

To get the best mortgage interest rate for your situation, it’s best to shop around with multiple lenders. Until the housing market cools off, most of us will be looking to the markets to invest and continue saving for the down payment. In 2020, the average list price on an American home was $374,500, with average interest rates on 30-year mortgages sitting at 3.11%.

Rates could be substantially higher when the loan first adjusts, and thereafter. Shopping around for quotes from multiple lenders is one of Bankrate’s most crucial pieces of advice for every mortgage applicant. When you shop, it’s important to think about not just the interest rate you’re being quoted, but also all the other terms of the loan. Be sure to compare APRs, which include many additional costs of the mortgage not shown in the interest rate. Keep in mind that some institutions may have lower closing costs than others, or your current bank may extend you a special offer.

When the federal funds rates increase, it becomes more expensive for banks to borrow from other banks. The higher costs for the bank can mean a higher interest rate on your mortgage. ARM loans that are in their fixed period (non-variable state) are not impacted by this increase. However if you suspect a federal increase is about to happen or it has just happened, you'll want to move fast if you're looking to make changes or have yet to lock in a fixed-rate mortgage. Higher interest rates mean higher monthly payments for borrowers.

No comments:

Post a Comment